When it comes to acquiring a new vehicle, consumers often find themselves at a crossroads: should they lease or buy? This decision can have significant financial implications and impact one’s lifestyle choices. Both options have their merits and drawbacks, and understanding these can help you make an informed decision that aligns with your financial goals and personal preferences.

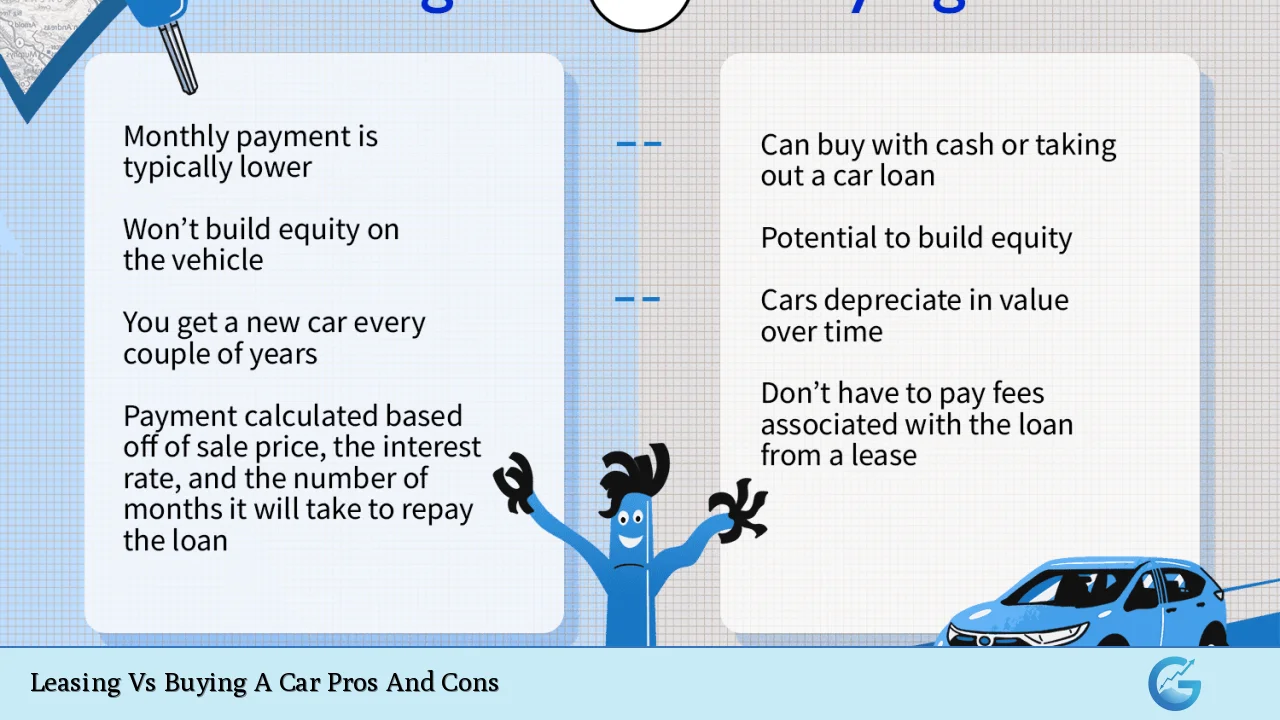

| Pros | Cons |

|---|---|

| Lower monthly payments for leasing | No ownership with leasing |

| Drive a new car every few years | Mileage restrictions on leases |

| Lower maintenance costs with leasing | Potential fees at lease-end |

| Ownership and equity buildup when buying | Higher monthly payments for buying |

| No mileage restrictions when buying | Depreciation affects resale value |

| Freedom to modify when owning | Higher maintenance costs for older owned cars |

Lower Monthly Payments: The Allure of Leasing

One of the most attractive aspects of leasing a car is the potential for lower monthly payments compared to buying. This financial advantage stems from the fundamental structure of a lease agreement:

- You’re only paying for the vehicle’s depreciation during the lease term, not its full value

- Lease terms are typically shorter than loan terms, spreading costs over a briefer period

- Many leases come with lower down payments, reducing initial out-of-pocket expenses

For investors and finance-savvy individuals, lower monthly payments can free up capital for other investments or financial goals. This liquidity advantage can be particularly appealing in a dynamic market environment where having available funds for opportunistic investments in stocks, cryptocurrencies, or forex trading can be crucial.

The New Car Experience: Leasing’s Technological Edge

Leasing offers the opportunity to drive a new car every few years, which comes with several advantages:

- Access to the latest automotive technology and safety features

- Enjoyment of modern comforts and improved fuel efficiency

- Staying current with evolving electric and hybrid vehicle options

For those interested in the intersection of technology and finance, regularly upgrading to newer models allows you to experience firsthand how automotive advancements might influence related markets. For instance, developments in electric vehicles can have ripple effects on energy sector investments or cryptocurrency projects focused on sustainable technologies.

Maintenance Simplicity: The Lease Advantage

Leasing a car often comes with the benefit of lower maintenance costs:

- Most leased vehicles are covered under warranty for the duration of the lease

- Some lease agreements include maintenance packages

- Newer cars generally require less frequent and less expensive maintenance

This aspect of leasing can be particularly attractive to those who view their vehicle as a tool rather than an asset. By minimizing unexpected maintenance expenses, lessees can maintain more predictable cash flows, which is valuable for budgeting and financial planning.

Ownership and Equity: The Long-Term Benefits of Buying

When you buy a car, either outright or through financing, you’re building equity with each payment:

- Once the loan is paid off, you own a valuable asset

- You can sell or trade in the vehicle at any time

- There’s potential for the car to retain significant value, especially for certain models

From an investment perspective, car ownership can be viewed as a form of forced savings. While cars typically depreciate, having a paid-off vehicle means you have an asset that can be liquidated if needed, providing a financial safety net.

Freedom of Use: The Flexibility of Ownership

Buying a car provides unparalleled freedom in how you use and modify your vehicle:

- No mileage restrictions, unlike most lease agreements

- Ability to customize or upgrade the car as desired

- No concerns about wear and tear charges at the end of a lease term

For entrepreneurs or those with variable driving needs, this flexibility can be invaluable. Whether it’s using your vehicle for a side business or embarking on long road trips, ownership ensures you’re not constrained by lease terms.

The Cost of Ownership: Higher Payments and Depreciation

While buying a car offers long-term benefits, it often comes with higher upfront and monthly costs:

- Down payments are typically larger than lease inception fees

- Monthly loan payments are usually higher than lease payments

- You’re responsible for the full purchase price, not just the depreciation

It’s crucial to consider how these higher costs might affect your overall financial strategy. The capital tied up in a car loan could potentially yield better returns if invested elsewhere, especially in high-growth sectors like technology stocks or emerging cryptocurrencies.

The Depreciation Factor: A Buyer’s Consideration

One of the most significant drawbacks of buying a car is dealing with depreciation:

- New cars can lose 20-30% of their value in the first year

- Depreciation continues throughout ownership, affecting resale value

- Some models depreciate faster than others, impacting long-term value

For the financially astute, understanding and mitigating depreciation is key. Researching models known for holding their value, considering certified pre-owned vehicles, and timing purchases around model year changes can help minimize the impact of depreciation.

Maintenance Responsibilities: The Long-Term Cost of Ownership

As a car ages, maintenance costs typically increase:

- After the warranty period, all repairs are the owner’s responsibility

- Older cars may require more frequent and expensive repairs

- Major components like transmissions and engines can fail, leading to significant expenses

From a financial planning perspective, it’s wise to factor in increasing maintenance costs over time. Setting aside a portion of what would have been lease payments into a dedicated maintenance fund can help smooth out these expenses and prevent financial strain.

The Lease-End Dilemma: Fees and Decisions

While leasing offers many advantages, the end of a lease term can present challenges:

- Potential fees for excess mileage or wear and tear

- The decision to buy out the lease, start a new lease, or transition to ownership

- Possible market value discrepancies if considering a buyout

For those adept at negotiation and market analysis, lease-end can present opportunities. Understanding the vehicle’s market value versus the buyout price can sometimes lead to advantageous purchases, especially if the car has retained more value than anticipated.

Financial Flexibility: Leasing’s Double-Edged Sword

Leasing provides certain financial flexibilities that can be both advantageous and limiting:

- Easier to change vehicles to match changing life circumstances

- Potential tax benefits for business use of leased vehicles

- Limited long-term financial commitment compared to buying

However, this flexibility comes at a cost:

- Continuous payments without building equity

- Potential for higher overall costs if leasing long-term

- Less financial incentive to maintain the vehicle meticulously

For those involved in dynamic financial markets, the flexibility of leasing might align well with a strategy that prioritizes liquidity and adaptability. However, it’s essential to weigh this against the long-term cost implications and the opportunity cost of not building equity.

The Investment Perspective: Opportunity Costs and Alternative Uses of Capital

When deciding between leasing and buying, it’s crucial to consider the opportunity costs:

- Capital used for a down payment on a purchased car could be invested elsewhere

- Lower lease payments might allow for more aggressive investment strategies

- The total cost of ownership over time needs to be compared to potential investment returns

In a world where cryptocurrency markets, forex trading, and innovative financial products offer potentially high returns, the decision to allocate substantial capital to a depreciating asset like a car should be carefully evaluated.

Regional Considerations: The Impact of Location on the Lease vs. Buy Decision

The choice between leasing and buying can be influenced by regional factors:

- Urban areas with good public transportation might favor leasing for occasional use

- Rural areas with high mileage needs might benefit from ownership

- States with different tax structures can affect the cost-benefit analysis of leasing vs. buying

Understanding these regional nuances is crucial for making an informed decision that aligns with both your financial goals and practical needs.

In conclusion, the decision to lease or buy a car is not just about transportation; it’s a significant financial choice that can impact your overall economic strategy. By carefully weighing the pros and cons, considering your personal circumstances, and aligning the decision with your broader financial goals, you can make a choice that supports your financial well-being and lifestyle needs.

Frequently Asked Questions About Leasing Vs Buying A Car Pros And Cons

- Is it always cheaper to lease a car than to buy one?

Not necessarily. While lease payments are often lower monthly, buying can be more cost-effective long-term, especially if you keep the car for many years after the loan is paid off. - Can leasing a car be a good option for business owners?

Yes, leasing can offer tax advantages for businesses. It may allow for deducting lease payments as a business expense, potentially reducing taxable income. - What happens if I exceed the mileage limit on a leased car?

You’ll typically be charged a per-mile fee for exceeding the agreed-upon mileage limit. These fees can add up quickly, so it’s important to estimate your driving needs accurately. - Is it possible to negotiate the purchase price of a car at the end of a lease?

Yes, the buyout price at the end of a lease can often be negotiated, especially if the car’s market value is different from the predetermined residual value. - How does leasing or buying a car affect my credit score?

Both leasing and buying with a loan can impact your credit score. Regular, on-time payments can improve your score, while missed payments can negatively affect it. - Are maintenance costs always lower for leased vehicles?

Generally, yes. Leased cars are usually newer and under warranty, reducing maintenance costs. However, you’re still responsible for regular maintenance like oil changes. - Can I modify a leased car?

Typically, modifications to leased vehicles are discouraged or prohibited. Any changes usually need to be reversed before returning the car, which can be costly. - Is it better to buy a car if I plan to keep it for a long time?

In most cases, yes. Buying becomes more cost-effective the longer you keep the car, especially after the loan is paid off and you’re no longer making monthly payments.