Lexington Law is a prominent credit repair service that has been operating for nearly three decades, specializing in helping individuals improve their credit scores by disputing inaccuracies on their credit reports. As the landscape of personal finance becomes increasingly complex, understanding the advantages and disadvantages of utilizing a service like Lexington Law is crucial for anyone looking to enhance their financial standing. This article will delve into the pros and cons of Lexington Law, providing a comprehensive overview to assist potential clients in making informed decisions.

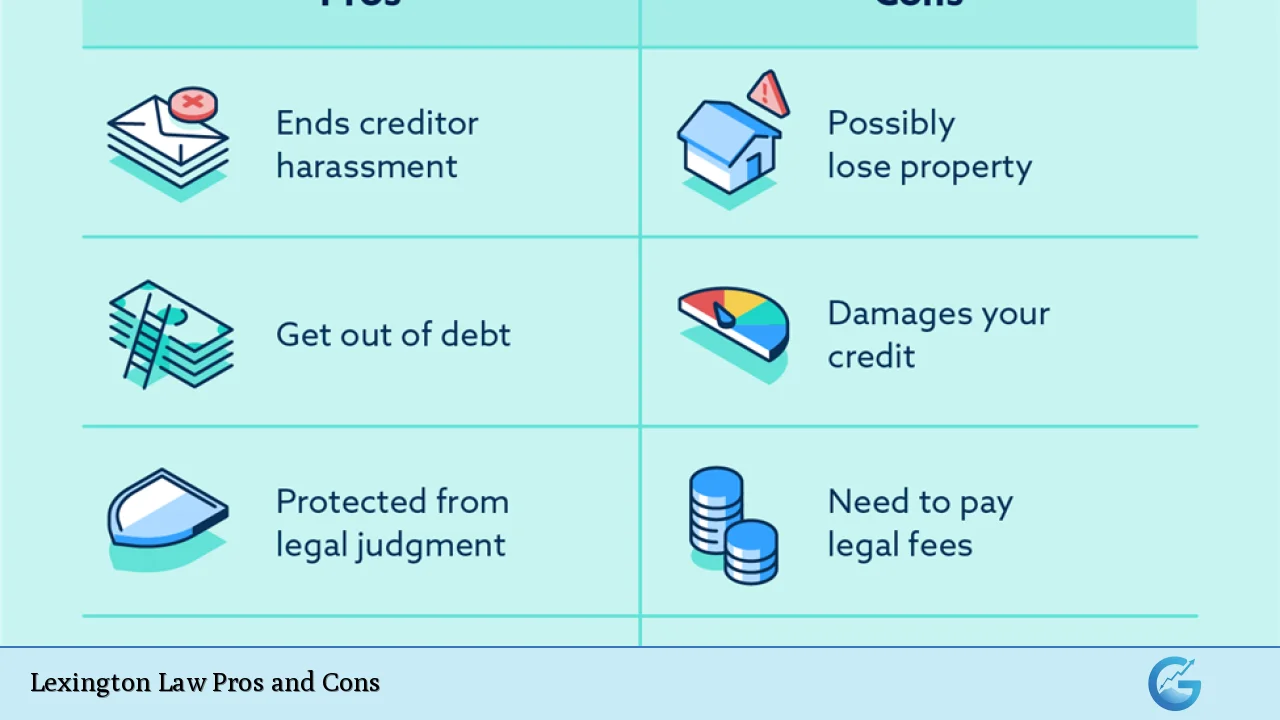

| Pros | Cons |

|---|---|

| Expertise from a licensed law firm | High monthly fees compared to competitors |

| Comprehensive range of services | No money-back guarantee or satisfaction guarantee |

| Flexible month-to-month subscription model | Past legal issues and lawsuits raise concerns |

| Identity theft protection included | Limited credit monitoring features in lower tiers |

| Positive customer reviews and high ratings on platforms like Trustpilot | Not accredited by the Better Business Bureau (BBB) |

| Free initial consultation offered | No guarantee of results; outcomes may vary significantly |

| Access to legal professionals for credit-related issues | Potentially confusing pricing structure with multiple tiers |

| Ability to handle various types of credit issues, including identity theft and medical debt. | Some customers report dissatisfaction with the effectiveness of services. |

Expertise from a Licensed Law Firm

One of the primary advantages of Lexington Law is that it operates as a licensed law firm. This means that clients benefit from legal expertise in credit repair, which is not the case with many other credit repair companies. The team includes attorneys and paralegals who are well-versed in consumer protection laws, enabling them to navigate complex legal frameworks effectively.

- Legal Knowledge: Clients receive guidance based on a deep understanding of credit laws.

- Formal Dispute Processes: The firm can initiate formal disputes with creditors and credit bureaus, leveraging legal channels that non-law firms cannot.

Comprehensive Range of Services

Lexington Law offers a wide variety of services designed to address different aspects of credit repair. These include:

- Credit Report Analysis: A thorough review of clients’ credit reports to identify inaccuracies.

- Dispute Services: Assistance in disputing negative items on credit reports across all three major bureaus.

- Identity Theft Protection: Coverage that helps clients safeguard against identity theft, which can severely impact credit scores.

Flexible Month-to-Month Subscription Model

Unlike many other credit repair companies that require long-term contracts, Lexington Law operates on a flexible month-to-month subscription basis. This allows clients to cancel their services at any time without incurring additional fees.

- No Long-Term Commitment: Clients can choose to discontinue services if they are not satisfied with the progress.

- Easy Cancellation Policy: The process for cancellation is straightforward, providing peace of mind for clients.

Identity Theft Protection Included

Lexington Law includes identity theft protection as part of its service offerings. This feature is particularly valuable given the increasing prevalence of identity theft in today’s digital age.

- Comprehensive Coverage: Clients receive up to $1 million in identity theft insurance, which can cover expenses related to restoring their identity.

Positive Customer Reviews

Lexington Law has garnered positive reviews from many clients on platforms like Trustpilot. Satisfied customers often highlight significant improvements in their credit scores after utilizing the firm’s services.

- High Ratings: Many users report successful removals of negative items from their credit reports.

- Customer Support: The firm’s customer service is generally well-rated, with representatives often being knowledgeable paralegals.

Free Initial Consultation Offered

Potential clients can take advantage of a free consultation to assess whether Lexington Law’s services are suitable for their needs. This initial meeting allows individuals to understand what they can expect before committing financially.

- Personalized Assessment: During the consultation, clients receive tailored advice based on their specific credit situations.

High Monthly Fees Compared to Competitors

Despite its advantages, one significant drawback is the cost associated with Lexington Law’s services. Monthly fees can be significantly higher than those charged by other credit repair companies.

- Pricing Structure: Plans start around $89.95 per month and can go up to $139.95 or more for premium services, which may not be feasible for all consumers.

No Money-Back Guarantee or Satisfaction Guarantee

Unlike some competitors, Lexington Law does not offer a money-back guarantee or satisfaction guarantee. This lack of assurance can be concerning for potential clients who might worry about investing money without guaranteed results.

- Risk Factor: Clients may find themselves paying for services without seeing any tangible improvements in their credit scores.

Past Legal Issues and Lawsuits Raise Concerns

Lexington Law has faced several legal challenges over the years, including allegations related to deceptive practices and violations of consumer protection laws. While these issues have been addressed, they still raise questions about the firm’s integrity.

- Consumer Financial Protection Bureau (CFPB) Lawsuit: In 2019, the CFPB filed a lawsuit against Lexington Law for alleged deceptive marketing practices.

Limited Credit Monitoring Features in Lower Tiers

While higher-tier plans offer comprehensive monitoring features, lower-tier plans provide limited access to these tools. This can be a disadvantage for clients who want continuous oversight over their credit status.

- Basic Monitoring Services: Clients in lower tiers may miss out on valuable insights regarding changes to their credit reports.

Not Accredited by the Better Business Bureau (BBB)

Another notable con is that Lexington Law is not accredited by the BBB and has received mixed reviews regarding customer service. This lack of accreditation may deter some potential clients who value BBB ratings when selecting service providers.

- Caution Advised: Prospective customers should consider this factor when evaluating whether to engage with Lexington Law.

No Guarantee of Results; Outcomes May Vary Significantly

While many clients report success stories, there are no guarantees that all individuals will experience similar outcomes. Credit repair is inherently unpredictable due to varying financial situations and histories.

- Individual Variability: Results depend heavily on each client’s unique circumstances and the nature of their credit issues.

Potentially Confusing Pricing Structure with Multiple Tiers

Lexington Law offers several service tiers that can be confusing for potential clients trying to determine which plan best fits their needs. The complexity may lead some customers to choose plans that do not align with their specific requirements.

- Need for Clarity: Clearer communication about what each tier includes could enhance customer satisfaction and decision-making processes.

Some Customers Report Dissatisfaction with Effectiveness

Despite positive reviews from many users, there are also reports from dissatisfied customers who feel that Lexington Law did not deliver on its promises or provide satisfactory results within an expected timeframe.

- Expectations vs. Reality: Some clients have expressed frustration over perceived lack of progress after several months of service.

In conclusion, while Lexington Law offers several advantages such as legal expertise, a wide range of services, and positive customer feedback, it also presents notable disadvantages including high costs, past legal issues, and no guarantees on results. Individuals considering using Lexington Law should weigh these factors carefully against their personal financial situations and goals before making a decision.

Frequently Asked Questions About Lexington Law

- What types of services does Lexington Law provide?

Lexington Law offers services including credit report analysis, dispute assistance with creditors and bureaus, identity theft protection, and personalized financial strategies. - How much does it cost to use Lexington Law?

The monthly fees range from approximately $89.95 to $139.95 depending on the plan selected. - Is there a money-back guarantee with Lexington Law?

No, Lexington Law does not offer a money-back guarantee or satisfaction guarantee for its services. - Can I cancel my subscription at any time?

Yes, clients can cancel their subscription at any time without incurring additional fees. - Does Lexington Law have good customer reviews?

Many customers have reported positive experiences with Lexington Law; however, there are also complaints regarding effectiveness. - Is Lexington Law accredited by the Better Business Bureau?

No, Lexington Law is not accredited by the BBB and has received mixed reviews. - How long does it typically take to see results?

The timeline for seeing results varies greatly among individuals but generally ranges from three months to a year. - What happens if I don’t see improvements in my credit score?

If improvements are not seen after using their services for an extended period, clients may choose to cancel their subscription without penalty.

Overall, understanding both the strengths and weaknesses of Lexington Law will empower consumers in making informed decisions about managing their financial health effectively.