When starting a business, one of the most crucial decisions entrepreneurs face is choosing the right business structure. Two popular options are Limited Liability Companies (LLCs) and Corporations. Both entities offer distinct advantages and disadvantages, and understanding these can significantly impact the success and growth of your business. This comprehensive guide will delve into the pros and cons of LLCs and Corporations, helping you make an informed decision for your venture.

| Pros | Cons |

|---|---|

| Limited Liability Protection | Complexity in Formation and Maintenance |

| Flexible Management Structure | Potential for Higher Taxes |

| Pass-Through Taxation | Limited Access to Capital |

| Fewer Formalities | Restrictions on Ownership Transfer |

| Credibility and Professionalism | Self-Employment Taxes |

Limited Liability Protection

Both LLCs and Corporations offer limited liability protection, which is a significant advantage over sole proprietorships and general partnerships.

This protection shields the personal assets of business owners from the company’s debts and liabilities.

Advantages:

- Personal assets are protected from business debts and lawsuits

- Reduced financial risk for business owners

- Encourages entrepreneurship and risk-taking

However, it’s important to note that this protection is not absolute. In cases of fraud, negligence, or personal guarantees, owners may still be held personally liable.

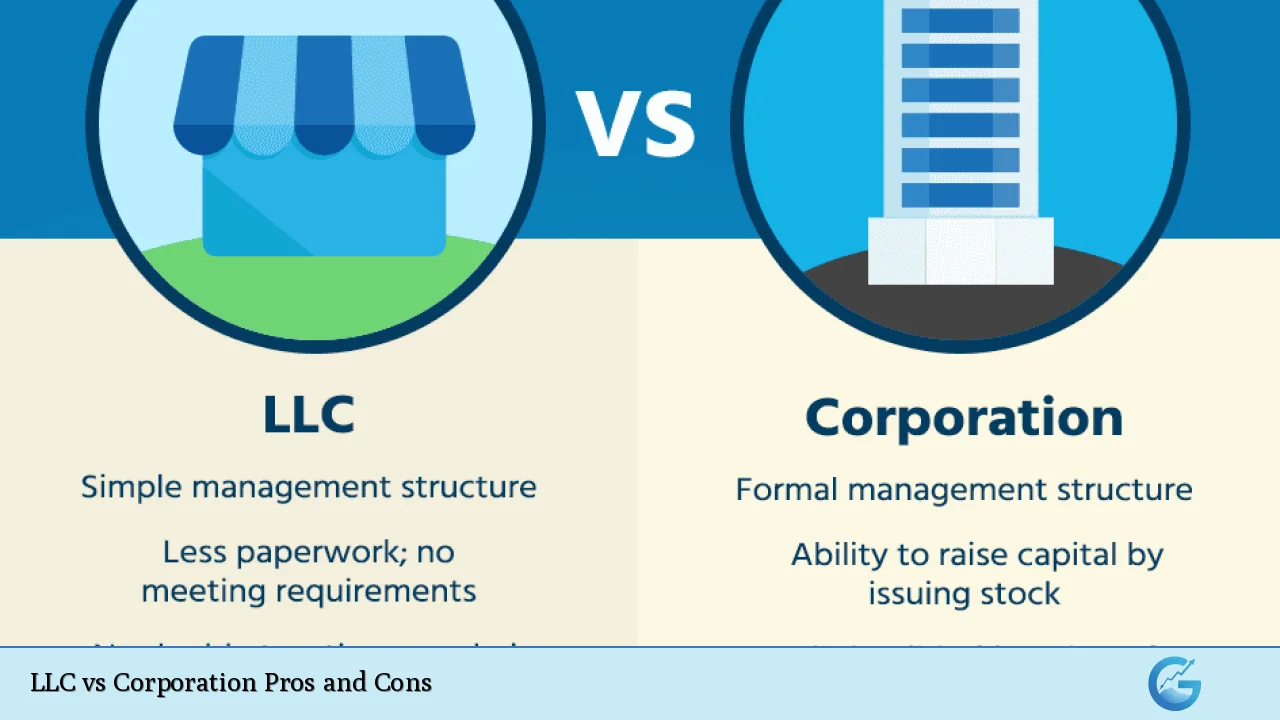

Flexible Management Structure

LLCs offer more flexibility in management compared to Corporations, which can be advantageous for small businesses and startups.

Advantages of LLC management:

- Can be member-managed or manager-managed

- No requirement for a board of directors or officers

- Ability to customize management structure through operating agreements

Corporations, on the other hand, have a more rigid structure:

- Required to have a board of directors

- Must appoint officers (e.g., CEO, CFO)

- Annual shareholder meetings are mandatory

The flexibility of LLCs can be particularly beneficial for businesses in dynamic industries or those with unique operational needs.

Pass-Through Taxation

One of the most significant advantages of LLCs is pass-through taxation, which can result in substantial tax savings for business owners.

Benefits of pass-through taxation:

- Business income is reported on personal tax returns

- Avoids double taxation faced by C Corporations

- Potential for lower overall tax burden

Corporations, particularly C Corporations, face double taxation:

- Corporate profits are taxed at the corporate level

- Dividends paid to shareholders are taxed again at the individual level

However, S Corporations can elect for pass-through taxation, combining some benefits of both structures.

Fewer Formalities

LLCs generally have fewer formal requirements compared to Corporations, which can save time and resources for business owners.

Reduced formalities for LLCs:

- No requirement for regular board meetings

- Less stringent record-keeping requirements

- Simplified decision-making processes

Corporate formalities:

- Regular board and shareholder meetings

- Detailed record-keeping of corporate minutes

- Strict adherence to bylaws and corporate governance

The reduced formalities of LLCs can be particularly advantageous for small businesses and startups with limited resources.

Credibility and Professionalism

Both LLCs and Corporations can enhance the credibility and professional image of a business, which can be crucial for attracting clients, partners, and investors.

Benefits of formal business structures:

- Increased perceived legitimacy in the marketplace

- Easier to establish business credit

- More attractive to potential employees

However, Corporations may have a slight edge in terms of perceived prestige, especially in certain industries or when dealing with large, established companies.

Complexity in Formation and Maintenance

While both LLCs and Corporations require formal registration with the state, Corporations generally involve more complex formation and maintenance procedures.

LLC formation simplicity:

- Filing Articles of Organization

- Creating an Operating Agreement (recommended but not always required)

- Annual report filing in most states

Corporate formation complexity:

- Filing Articles of Incorporation

- Drafting bylaws

- Issuing stock certificates

- Holding initial board meetings

- More frequent state filings and reports

The increased complexity of corporate formation and maintenance can be a significant drawback for small businesses with limited resources or legal expertise.

Potential for Higher Taxes

While LLCs benefit from pass-through taxation, there are scenarios where they may face higher tax burdens compared to Corporations.

Potential tax disadvantages for LLCs:

- Self-employment taxes on all profits

- Limited ability to retain earnings at lower corporate tax rates

- Fewer options for fringe benefits

Corporate tax advantages:

- Ability to retain earnings at corporate tax rates

- More options for tax-deductible fringe benefits

- Potential for lower overall tax burden in high-income scenarios

It’s crucial for business owners to consult with tax professionals to determine the most tax-efficient structure for their specific situation.

Limited Access to Capital

When it comes to raising capital, Corporations generally have an advantage over LLCs, which can be a significant factor for businesses planning rapid growth or expansion.

LLC capital limitations:

- Cannot issue stock

- May be less attractive to venture capitalists and angel investors

- Limited options for employee ownership incentives

Corporate capital advantages:

- Ability to issue various classes of stock

- More attractive to institutional investors

- Can offer stock options to employees

However, LLCs can still access capital through bank loans, member contributions, and certain types of private investments.

Restrictions on Ownership Transfer

LLCs often face more restrictions when it comes to transferring ownership compared to Corporations, which can be a drawback for businesses planning for future sales or transitions.

LLC ownership transfer challenges:

- May require unanimous consent from other members

- Potential dissolution of the LLC upon member exit

- Limited marketability of membership interests

Corporate ownership transfer advantages:

- Easily transferable shares of stock

- No impact on company existence when shareholders change

- Greater flexibility in ownership structure

These restrictions can make LLCs less attractive for businesses that anticipate frequent ownership changes or plan to go public in the future.

Self-Employment Taxes

LLC members who are active in the business are generally subject to self-employment taxes on their entire share of business profits, which can result in a higher tax burden.

Self-employment tax considerations for LLCs:

- 15.3% tax rate on all profits (up to the Social Security wage base)

- Applies to both distributed and undistributed profits

- Limited ability to characterize income as passive

Corporate tax treatment:

- Only salaries are subject to employment taxes

- Dividends are not subject to self-employment taxes

- Greater flexibility in income characterization

The self-employment tax burden can be a significant drawback for high-income LLC members, potentially outweighing other tax benefits of the structure.

In conclusion, choosing between an LLC and a Corporation involves carefully weighing the pros and cons of each structure against your specific business needs, goals, and circumstances. While LLCs offer flexibility and simplicity, Corporations provide advantages in capital raising and certain tax situations. It’s essential to consider factors such as liability protection, tax implications, management preferences, and future growth plans when making this critical decision. Consulting with legal and financial professionals can provide valuable insights tailored to your unique business situation, ensuring you make the most informed choice for your venture’s success.

Frequently Asked Questions About LLC vs Corporation Pros and Cons

- Can an LLC be taxed as a Corporation?

Yes, an LLC can elect to be taxed as an S Corporation or C Corporation by filing Form 8832 with the IRS. This can potentially provide tax benefits in certain situations. - Are there any restrictions on who can own an LLC or Corporation?

LLCs generally have fewer restrictions on ownership. S Corporations are limited to 100 shareholders and cannot have non-U.S. citizen owners, while C Corporations have no such restrictions. - Which structure is better for raising capital from investors?

Corporations are typically preferred for raising capital, especially from venture capitalists and through public offerings. They can issue stock and have a structure familiar to most investors. - Do LLCs and Corporations offer the same level of liability protection?

Both offer limited liability protection, but the strength can vary by state and circumstances. Proper maintenance of corporate formalities is crucial for preserving this protection in both structures. - Can I convert my LLC to a Corporation (or vice versa) later?

Yes, it’s possible to convert between these entities. However, the process can be complex and may have tax implications, so it’s advisable to consult with legal and tax professionals. - Which structure is better for a small business or startup?

LLCs are often preferred for small businesses due to their flexibility and simplicity. However, startups planning rapid growth and outside investment might benefit more from a corporate structure. - Are there differences in how LLCs and Corporations are treated internationally?

Yes, the recognition and treatment of LLCs can vary in international jurisdictions, while Corporations are more universally recognized. This can be important for businesses operating globally. - How do the costs of forming and maintaining an LLC compare to a Corporation?

Generally, LLCs have lower formation and maintenance costs due to fewer formal requirements. Corporations often incur higher costs due to more complex filing requirements and ongoing compliance needs.