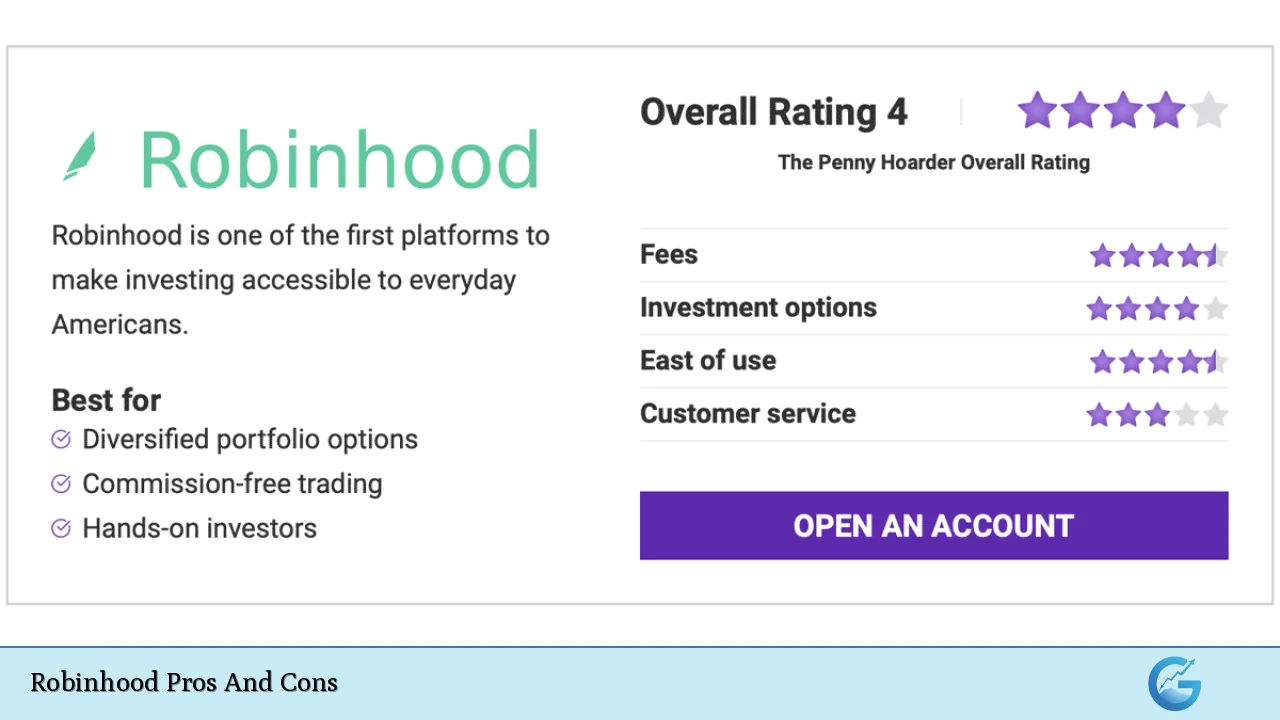

Robinhood has emerged as a significant player in the financial services industry, particularly appealing to novice investors and those interested in trading stocks, ETFs, options, and cryptocurrencies. Launched in 2013, Robinhood’s mission is to democratize finance for all by offering commission-free trading through a user-friendly mobile app. While the platform has gained a substantial following due to its simplicity and accessibility, it also faces criticism regarding its business practices and customer service. This article explores the various advantages and disadvantages of using Robinhood for investing.

| Pros | Cons |

|---|---|

| No commission fees for trades | Limited customer support options |

| User-friendly interface | Restricted trading during market volatility |

| Access to cryptocurrencies | Lack of advanced trading tools |

| Fractional share trading available | Payment for order flow model raises concerns |

| Cash management features with high APY for Gold members | No mutual funds or fixed-income investments offered |

| Educational resources for beginners | Potential for addiction due to gamified interface |

| Ability to trade 24/7 in select markets | Limited selection of cryptocurrencies compared to competitors |

| IRA matching contributions for Gold members | Concerns about security and data privacy |

No Commission Fees for Trades

One of Robinhood’s most appealing features is its zero-commission trading model, which allows users to buy and sell stocks, ETFs, options, and cryptocurrencies without incurring any fees. This approach has disrupted traditional brokerage models and made investing more accessible to a broader audience.

- Cost-effective: Investors can execute trades without worrying about commissions eating into their profits.

- Encourages frequent trading: The absence of fees allows users to experiment with their investment strategies without financial penalties.

User-Friendly Interface

Robinhood is designed with simplicity in mind, making it an excellent choice for beginner investors who may feel overwhelmed by more complex platforms.

- Intuitive design: The app’s clean layout makes navigation straightforward, allowing users to quickly find the information they need.

- Mobile-first approach: With a focus on mobile usability, investors can trade on-the-go, making it convenient for those with busy lifestyles.

Access to Cryptocurrencies

The platform allows users to trade various cryptocurrencies alongside traditional securities, catering to the growing interest in digital assets.

- Diverse offerings: Users can buy and sell popular cryptocurrencies like Bitcoin and Ethereum directly from the app.

- No commissions on crypto trades: Similar to stock trading, Robinhood does not charge commissions for cryptocurrency transactions.

Fractional Share Trading Available

Robinhood enables users to purchase fractional shares of stocks, allowing them to invest in high-priced stocks without needing substantial capital upfront.

- Lower barriers to entry: Investors can start building a diversified portfolio with smaller amounts of money.

- Flexibility in investment: Users can allocate their funds across multiple stocks instead of being limited by share prices.

Cash Management Features with High APY for Gold Members

Robinhood offers cash management features that allow users to earn interest on uninvested cash balances. Gold members can earn significantly higher interest rates compared to standard accounts.

- Attractive APY: Gold members can earn up to 4.25% APY on uninvested cash, which is competitive compared to traditional savings accounts.

- Convenient cash management: Users can easily manage their cash while still having access to trading capabilities.

Educational Resources for Beginners

Robinhood provides a range of educational materials aimed at helping new investors understand the basics of investing and trading.

- Learning tools: The platform includes articles and tutorials that cover various financial topics, helping users make informed decisions.

- Risk awareness: Educational content emphasizes the risks associated with active trading, encouraging responsible investing practices.

Ability to Trade 24/7 in Select Markets

With Robinhood’s recent updates, users can trade select stocks and ETFs 24 hours a day during weekdays, providing more flexibility in trading times.

- Increased accessibility: Investors can react quickly to market news or trends outside regular trading hours.

- Global market engagement: This feature allows users to participate in international markets that operate outside U.S. hours.

IRA Matching Contributions for Gold Members

Robinhood offers an IRA account option that includes matching contributions for Gold members, incentivizing retirement savings.

- 1% match on contributions: Regular customers receive a match on IRA contributions up to 1%, while Gold members get a 3% match.

- Encourages long-term saving: This feature promotes saving for retirement among younger investors who may not prioritize it otherwise.

Limited Customer Support Options

Despite its many advantages, Robinhood has faced criticism regarding its customer support services.

- Lack of direct support channels: Users often report difficulty reaching customer service representatives through phone or live chat.

- Reliance on automated responses: Many inquiries are handled through automated email responses rather than personalized assistance, leading to frustration among users seeking help with urgent issues.

Restricted Trading During Market Volatility

Robinhood has been criticized for restricting trades during periods of high volatility, notably during the GameStop short squeeze incident in early 2021.

- User dissatisfaction: Many traders felt their ability to capitalize on market opportunities was unfairly limited during critical moments.

- Regulatory scrutiny: These actions have led to increased scrutiny from regulators and lawmakers regarding Robinhood’s business practices and commitment to protecting retail investors.

Lack of Advanced Trading Tools

While Robinhood appeals to beginners with its simplicity, it lacks advanced tools that experienced traders often rely on.

- Minimal research capabilities: The platform does not offer comprehensive market analysis tools or detailed research reports.

- Limited order types: Advanced order types like stop-loss orders may not be available, which could hinder more sophisticated trading strategies.

Payment for Order Flow Model Raises Concerns

Robinhood’s business model relies heavily on payment for order flow (PFOF), which has raised ethical questions about whether this practice serves the best interests of retail investors.

- Potential conflicts of interest: Critics argue that PFOF may lead brokers like Robinhood to prioritize profit over securing the best execution prices for their clients.

- Transparency issues: Users may not fully understand how their trades are executed or how much they are paying indirectly through this model.

No Mutual Funds or Fixed-Income Investments Offered

Robinhood does not provide access to mutual funds or fixed-income investments such as bonds, limiting investment strategies available on the platform.

- Narrow investment options: Investors seeking diversification through mutual funds or fixed-income securities will need to look elsewhere.

- Focus on active trading: The platform primarily caters to those interested in active trading rather than long-term investment strategies involving diverse asset classes.

Potential for Addiction Due to Gamified Interface

The design of Robinhood’s app incorporates gamification elements that may encourage excessive trading behavior among users.

- Psychological impact: The colorful interface and instant gratification from quick trades can lead some users to engage in impulsive buying or selling.

- Risk of over-trading: This environment may tempt novice investors into making emotional decisions rather than strategic ones based on thorough analysis.

Limited Selection of Cryptocurrencies Compared to Competitors

While Robinhood offers cryptocurrency trading, its selection is more limited than that of dedicated crypto exchanges like Coinbase or Binance.

- Fewer options available: Users may find popular altcoins missing from Robinhood’s offerings.

- Potentially lower engagement with crypto markets: Investors looking for extensive cryptocurrency portfolios might prefer platforms that specialize in digital assets.

Concerns About Security and Data Privacy

As with any online financial service, security concerns are paramount. While Robinhood employs various security measures, incidents have raised questions about user safety and data privacy.

- Past security breaches: There have been reports of data breaches that compromised user information.

- User trust issues: Such incidents can undermine confidence in the platform’s ability to protect sensitive financial data effectively.

In conclusion, Robinhood presents both significant advantages and notable disadvantages as an investment platform. Its no-fee structure and user-friendly design make it particularly appealing for beginner investors looking to enter the financial markets without substantial initial investments. However, potential users should be aware of its limitations regarding customer support, advanced trading tools, and ethical concerns surrounding its business model.

As always when investing—especially in volatile markets—it’s crucial for individuals to conduct thorough research and consider their own financial goals before choosing a platform like Robinhood.

Frequently Asked Questions About Robinhood Pros And Cons

- What are the main advantages of using Robinhood?

The primary advantages include commission-free trades, a user-friendly interface suitable for beginners, access to cryptocurrencies, fractional share trading capabilities, and educational resources. - What are the main disadvantages of using Robinhood?

The main disadvantages include limited customer support options, restricted trading during market volatility events, lack of advanced trading tools, reliance on payment for order flow which raises ethical concerns, and no access to mutual funds. - Is Robinhood suitable for beginner investors?

Yes, Robinhood is particularly well-suited for beginner investors due to its simple interface and lack of commissions. - Can I trade cryptocurrencies on Robinhood?

Yes, Robinhood allows users to trade several popular cryptocurrencies without incurring commission fees. - Does Robinhood offer retirement accounts?

Yes, Robinhood provides Individual Retirement Accounts (IRAs) with matching contributions for Gold members. - What should I be cautious about when using Robinhood?

Caution is advised regarding limited customer support services and potential over-trading due to its gamified interface. - Are there any hidden fees associated with using Robinhood?

While trades are commission-free, there may be fees related to premium subscriptions or account transfers. - Is my money safe with Robinhood?

While Robinhood employs security measures like two-factor authentication and encryption, past incidents have raised concerns about data privacy.