Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefits, along with a cash value component. This policy combines the benefits of term life insurance with an investment savings element, making it an attractive option for those seeking long-term financial protection and wealth accumulation. However, like any financial product, universal life insurance comes with its own set of advantages and disadvantages that potential policyholders should carefully consider.

| Pros | Cons |

|---|---|

| Flexible premium payments | Complex policy structure |

| Adjustable death benefit | Potential for increased costs over time |

| Cash value accumulation | Market-dependent returns |

| Tax-deferred growth | Risk of policy lapse |

| Lifetime coverage | Higher initial premiums compared to term life |

| Loan options against cash value | Reduced death benefit if loans are unpaid |

| Potential for higher returns | Requires active management |

| Estate planning benefits | Surrender charges in early years |

Flexible Premium Payments

One of the most significant advantages of universal life policies is the flexibility they offer in premium payments. Unlike traditional whole life insurance, which requires fixed premium payments, universal life allows policyholders to adjust their premium amounts within certain limits.

- Policyholders can increase payments during high-income years to build cash value faster

- Premiums can be reduced or even skipped during financial hardships, provided there’s sufficient cash value

- This flexibility can be particularly beneficial for individuals with fluctuating incomes, such as freelancers or business owners

However, it’s crucial to note that while premium flexibility can be advantageous, consistently paying lower premiums or skipping payments can lead to a decrease in cash value and potentially cause the policy to lapse if not managed properly.

Adjustable Death Benefit

Universal life policies offer the unique feature of an adjustable death benefit, allowing policyholders to increase or decrease their coverage as their financial needs change over time.

- Policyholders can increase the death benefit to accommodate growing financial responsibilities, such as a new mortgage or the birth of a child

- The death benefit can be decreased to reduce premiums or to align with changing financial goals

- This feature provides a level of customization not available in most other types of life insurance

It’s important to understand that increasing the death benefit may require additional underwriting and could result in higher premiums, while decreasing it might affect the policy’s cash value and long-term performance.

Cash Value Accumulation

Universal life policies include a cash value component that can grow over time, providing a savings element alongside the death benefit.

- A portion of each premium payment goes into a cash value account

- The cash value grows tax-deferred, potentially at a higher rate than traditional savings accounts

- Policyholders can access this cash value through withdrawals or loans for various financial needs

While cash value accumulation can be a significant benefit, it’s essential to remember that the growth rate is not guaranteed and can fluctuate based on market conditions and the specific terms of the policy.

Tax-Deferred Growth

One of the most attractive features of universal life insurance for investors is the tax-deferred growth of the cash value component.

- The cash value grows without incurring annual taxes on the gains

- This tax-deferred status can lead to significant compound growth over time

- Policyholders can potentially access the cash value through tax-free loans, although this may reduce the death benefit if not repaid

It’s crucial to consult with a tax professional to fully understand the tax implications of universal life policies, as withdrawals above the cost basis may be subject to income tax.

Lifetime Coverage

Universal life insurance provides permanent coverage that lasts for the policyholder’s entire lifetime, as long as premiums are paid and the policy remains in force.

- Guaranteed coverage regardless of changes in health or insurability

- Peace of mind knowing beneficiaries will receive a death benefit whenever the policyholder passes away

- Can be an essential tool for estate planning and wealth transfer

While lifetime coverage is a significant advantage, it’s important to balance this benefit against the higher costs associated with permanent life insurance compared to term policies.

Loan Options Against Cash Value

Universal life policies allow policyholders to borrow against the accumulated cash value, providing a source of liquidity that can be used for various financial needs.

- Loans can be taken out without credit checks or loan applications

- Interest rates on policy loans are often lower than those of personal loans or credit cards

- Loan repayment terms are typically flexible, with the option to repay over time or from the death benefit

It’s crucial to understand that unpaid loans and interest will reduce the death benefit, potentially leaving beneficiaries with less than expected if not managed properly.

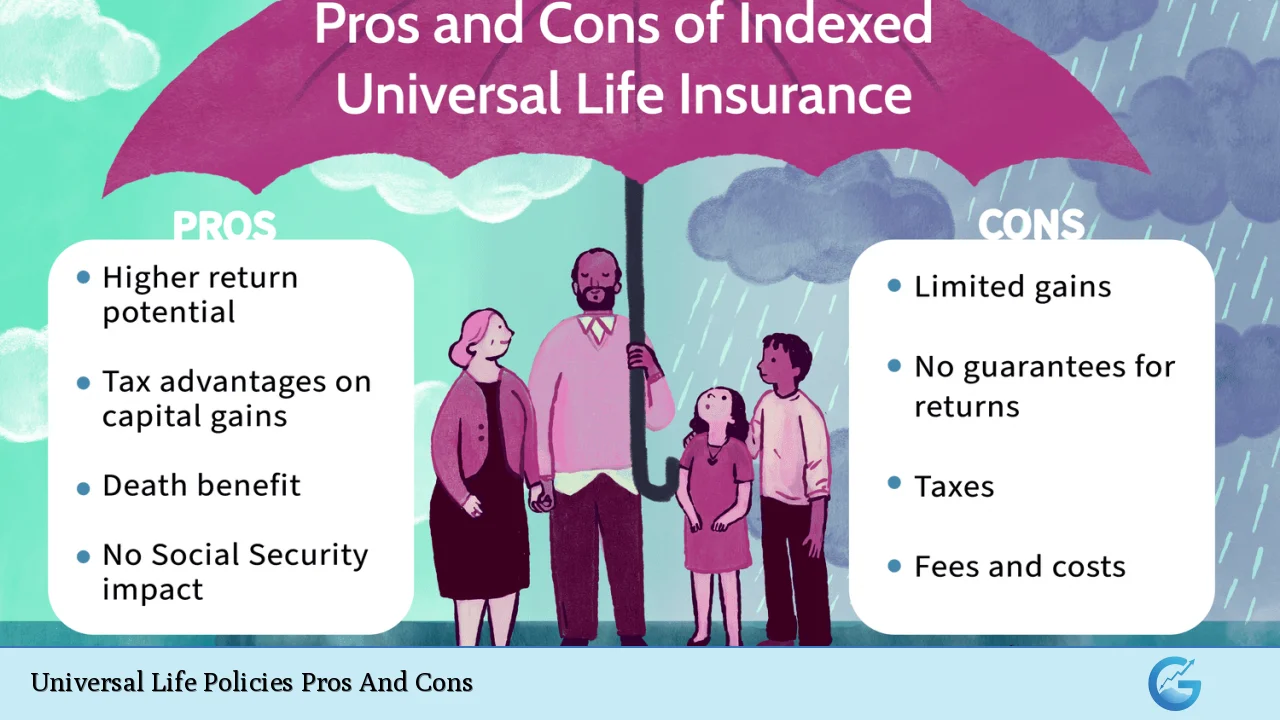

Potential for Higher Returns

Some types of universal life policies, such as indexed universal life (IUL) or variable universal life (VUL), offer the potential for higher returns compared to traditional whole life policies.

- IUL policies link cash value growth to the performance of a stock market index

- VUL policies allow policyholders to invest the cash value in a variety of sub-accounts, similar to mutual funds

- These options can provide opportunities for greater cash value accumulation in favorable market conditions

While the potential for higher returns exists, it’s important to note that these policies also come with increased risk, and returns are not guaranteed. Poor market performance can lead to lower cash value accumulation or even losses.

Estate Planning Benefits

Universal life insurance can be a valuable tool in estate planning, offering several benefits for wealth transfer and estate tax management.

- The death benefit is generally income-tax-free to beneficiaries

- Policies can be structured to help cover estate taxes, ensuring that assets are preserved for heirs

- Cash value can be accessed during the policyholder’s lifetime for retirement income or other needs

It’s essential to work with an experienced estate planning attorney and financial advisor to properly integrate universal life insurance into a comprehensive estate plan.

Complex Policy Structure

One of the primary disadvantages of universal life insurance is its complex structure, which can be challenging for policyholders to understand and manage effectively.

- Policies involve multiple components, including premiums, cash value, and death benefits

- Understanding how changes in one area affect others requires financial literacy

- Policyholders may need ongoing professional advice to optimize their policy

The complexity of universal life policies can lead to misunderstandings and potential mismanagement, making it crucial for policyholders to thoroughly educate themselves or seek professional guidance.

Potential for Increased Costs Over Time

While universal life policies offer premium flexibility, they also carry the risk of increasing costs over time, which can catch policyholders off guard.

- The cost of insurance within the policy typically increases as the policyholder ages

- If the cash value doesn’t grow as projected, higher premiums may be required to keep the policy in force

- Market downturns or sustained low interest rates can exacerbate this issue

Policyholders must be prepared for the possibility of paying higher premiums in later years to maintain their coverage, which can be challenging on a fixed income.

Market-Dependent Returns

The cash value growth in universal life policies, particularly in indexed and variable versions, is subject to market fluctuations, introducing an element of uncertainty.

- Poor market performance can result in lower cash value accumulation

- There’s a risk of not meeting projected returns, which can affect the policy’s long-term viability

- Market volatility can lead to the need for higher premium payments to keep the policy in force

While some policies offer minimum guaranteed returns, these are often lower than the projected rates used in policy illustrations, potentially leading to disappointment if actual returns fall short of expectations.

Risk of Policy Lapse

Universal life policies carry a risk of lapse if not properly funded or managed, which can result in a loss of coverage and potential tax consequences.

- If the cash value becomes insufficient to cover policy charges, additional premium payments may be required

- Failure to make these payments can cause the policy to lapse

- A lapsed policy may result in the loss of the death benefit and potential tax liability on any gains in the cash value

Regular policy reviews and proactive management are essential to prevent unintended policy lapses, which can have severe financial consequences for the policyholder.

Higher Initial Premiums Compared to Term Life

Universal life insurance typically requires higher initial premium payments compared to term life insurance, which can be a significant disadvantage for some individuals.

- The higher cost reflects the permanent nature of the coverage and the cash value component

- This can make universal life less accessible for younger individuals or those with limited budgets

- The opportunity cost of higher premiums should be considered against other potential investments

While universal life offers additional features beyond pure insurance coverage, the higher cost must be carefully weighed against the policyholder’s financial goals and budget constraints.

Reduced Death Benefit if Loans Are Unpaid

While the ability to take loans against the cash value is a benefit, unpaid loans can significantly impact the death benefit.

- Outstanding loans and interest are deducted from the death benefit upon the policyholder’s passing

- This reduction can leave beneficiaries with less financial protection than expected

- Large loans can potentially cause the policy to lapse if the cash value becomes insufficient to cover policy charges

Policyholders must carefully consider the long-term implications of policy loans and have a clear repayment strategy to avoid unintended consequences for their beneficiaries.

Requires Active Management

Universal life policies demand more active management compared to simpler insurance products, which can be a disadvantage for those seeking a “set it and forget it” solution.

- Regular reviews of policy performance and projections are necessary

- Adjustments to premiums or death benefits may be required over time

- Understanding and responding to market conditions affecting the policy is crucial

The need for ongoing management can be time-consuming and may require professional assistance, adding to the overall cost of maintaining the policy.

Surrender Charges in Early Years

Many universal life policies impose surrender charges if the policy is terminated or significant withdrawals are made in the early years.

- Surrender charges can be substantial, often decreasing over a period of 10-15 years

- These charges can significantly reduce the cash value available if the policy is surrendered prematurely

- The presence of surrender charges limits the policyholder’s flexibility in the early years of the policy

Potential policyholders should carefully consider their long-term commitment to the policy, as early termination can result in significant financial losses due to surrender charges.

In conclusion, universal life insurance offers a unique combination of flexibility, potential for cash value growth, and lifetime coverage that can be attractive for many individuals seeking comprehensive financial protection and wealth accumulation. However, the complexity of these policies, potential for increased costs, and need for active management present significant challenges that must be carefully considered. Prospective policyholders should thoroughly evaluate their financial goals, risk tolerance, and long-term needs before committing to a universal life policy. Consulting with experienced financial advisors and insurance professionals is crucial to ensure that a universal life policy aligns with one’s overall financial strategy and to navigate the intricacies of policy management over time.

Frequently Asked Questions About Universal Life Policies Pros And Cons

- How does universal life insurance differ from whole life insurance?

Universal life insurance offers more flexibility in premium payments and death benefits compared to whole life insurance. It also typically has a cash value component that can potentially earn higher returns, but with less guaranteed growth than whole life policies. - Can I access the cash value in my universal life policy without surrendering it?

Yes, you can typically access the cash value through policy loans or partial withdrawals. However, these actions may reduce the death benefit and could have tax implications if not managed properly. - What happens if I can’t pay the premiums on my universal life policy?

If you can’t pay premiums, the policy may use accumulated cash value to cover the costs. If the cash value is depleted, the policy could lapse, resulting in loss of coverage and potential tax consequences. - Are the returns on universal life policies guaranteed?

Most universal life policies offer a minimum guaranteed interest rate on the cash value. However, actual returns can fluctuate based on market conditions and policy type, especially for indexed or variable universal life policies. - How often should I review my universal life policy?

It’s recommended to review your policy annually or whenever there are significant changes in your financial situation. Regular reviews help ensure the policy remains aligned with your goals and is performing as expected. - Can I increase or decrease the death benefit on my universal life policy?

Yes, many universal life policies allow you to adjust the death benefit. Increasing it may require additional underwriting, while decreasing it could affect the policy’s cash value and tax status. - What are the tax implications of surrendering a universal life policy?

Surrendering a policy may result in taxable income if the cash surrender value exceeds the total premiums paid. It’s important to consult with a tax professional before surrendering a policy. - Is universal life insurance suitable for estate planning?

Universal life insurance can be an effective tool for estate planning, providing liquidity for estate taxes and facilitating wealth transfer. However, its suitability depends on individual circumstances and should be evaluated as part of a comprehensive estate plan.