When it comes to estate planning, individuals often find themselves at a crossroads between creating a will or establishing a trust. Both tools serve the essential purpose of distributing assets upon death, but they do so in distinct ways that can significantly impact the management and transfer of wealth. Understanding the pros and cons of each can help individuals make informed decisions aligned with their financial goals, particularly in the context of finance, crypto, forex, and money markets.

A will is a legal document that outlines how a person’s assets will be distributed after their death. It becomes effective only upon death and requires the probate process to validate its terms. In contrast, a trust is a legal arrangement that allows an individual (the grantor) to transfer assets to a trustee for management and distribution according to specific instructions. Trusts can take effect during the grantor’s lifetime or after death, offering various advantages in terms of control, privacy, and tax implications.

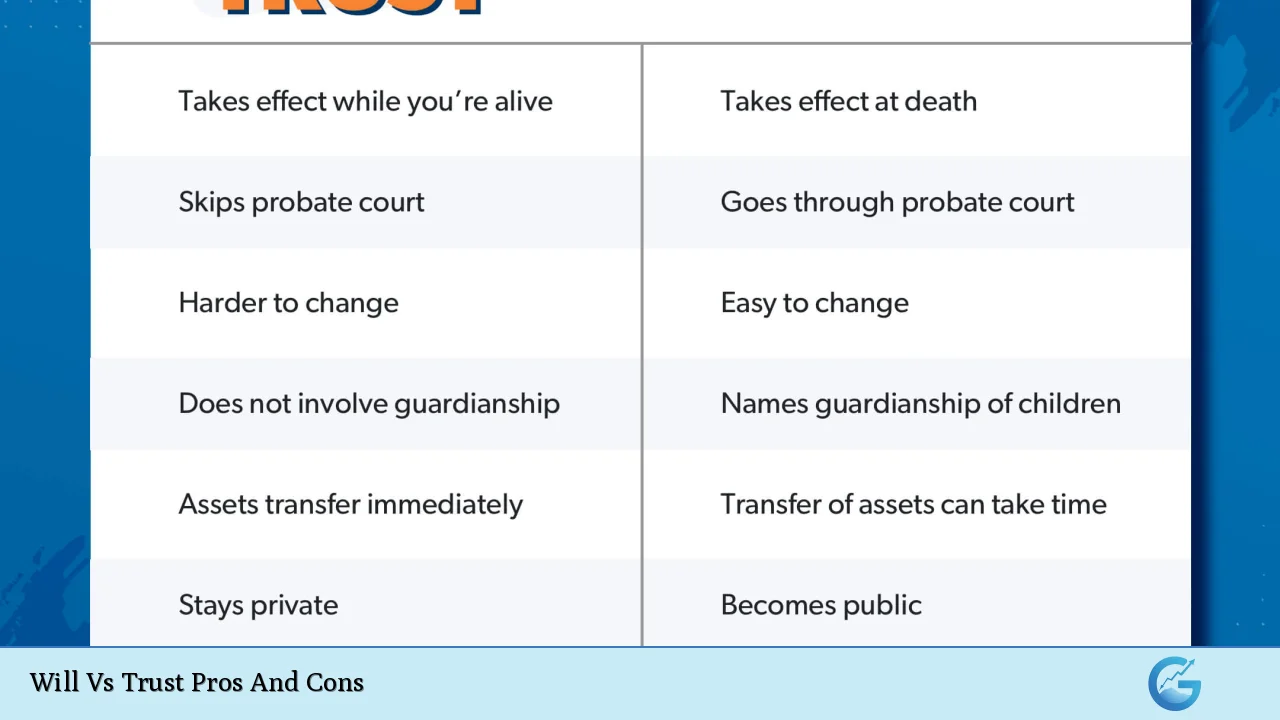

To provide a clearer comparison, here’s an overview of the advantages and disadvantages associated with wills and trusts:

| Pros | Cons |

|---|---|

| Wills are generally simpler and less expensive to create. | Wills must go through probate, which can be time-consuming and costly. |

| Wills allow for clear instructions regarding guardianship of minor children. | Wills become public records during probate, compromising privacy. |

| Wills can be easily updated or revoked as circumstances change. | Wills provide limited control over asset distribution after death. |

| Trusts avoid probate, facilitating faster asset distribution. | Trusts are more complex and often require higher initial costs to establish. |

| Trusts offer greater privacy since they do not become public records. | Trusts necessitate retitling assets, which can be time-consuming. |

| Trusts allow for ongoing management of assets in case of incapacity. | Irrevocable trusts may limit the grantor’s control over assets once established. |

| Trusts can provide tax benefits under certain conditions. | Some trusts may incur additional taxes depending on their structure. |

Simplicity and Cost

Advantages of Wills

- Affordability: Wills are typically less expensive to draft than trusts. The straightforward nature of wills means they often require less legal expertise.

- Ease of Creation: Most individuals can create a will without extensive legal knowledge, making them accessible for many.

Disadvantages of Wills

- Probate Process: A will must go through probate, which can be lengthy and costly. This process involves court supervision to validate the will and distribute assets.

- Public Record: Once probated, a will becomes part of the public record, meaning anyone can access its contents.

Control Over Asset Distribution

Advantages of Trusts

- Ongoing Management: Trusts allow for detailed instructions regarding asset management during the grantor’s lifetime and beyond. This is particularly beneficial if the grantor becomes incapacitated.

- Conditional Distributions: Grantors can set specific conditions for distributions to beneficiaries, such as age milestones or educational achievements.

Disadvantages of Trusts

- Complexity: Trusts are generally more complex than wills. They require careful drafting and understanding of legal language.

- Loss of Control: In irrevocable trusts, once assets are transferred into the trust, the grantor may lose control over those assets.

Privacy Concerns

Advantages of Trusts

- Confidentiality: Unlike wills, trusts do not go through probate and thus remain private. This aspect is crucial for individuals who wish to keep their financial matters confidential.

Disadvantages of Wills

- Lack of Privacy: The probate process makes wills public documents. This transparency can lead to potential disputes among heirs or unwanted scrutiny from outsiders.

Flexibility

Advantages of Wills

- Ease of Modification: Wills can be easily updated or revoked at any time while the testator is alive. This flexibility allows individuals to adjust their plans as life circumstances change.

Disadvantages of Trusts

- Rigidity in Irrevocable Trusts: While revocable trusts offer flexibility, irrevocable trusts do not allow changes once established. This limitation can lead to complications if circumstances change unexpectedly.

Tax Implications

Advantages of Trusts

- Tax Benefits: Certain types of trusts can provide significant tax advantages by reducing estate taxes or allowing for more favorable tax treatment on income generated by trust assets.

Disadvantages of Wills

- No Tax Benefits: Wills do not offer mechanisms for minimizing estate taxes. As such, estates may face higher tax burdens upon distribution.

Conclusion

Choosing between a will and a trust is a critical decision that depends on individual circumstances, including the size and complexity of one’s estate, privacy concerns, and personal preferences regarding asset distribution.

Both tools have distinct advantages and disadvantages that must be carefully weighed. For those with simpler estates or who prioritize cost-effectiveness, a will may suffice. However, for individuals with larger estates or specific wishes regarding asset management post-death or incapacity, establishing a trust could provide enhanced benefits.

In conclusion, it’s advisable to consult with financial advisors or estate planning attorneys who can provide tailored advice based on your unique situation. Proper planning ensures that your estate is managed according to your wishes while minimizing potential complications for your beneficiaries.

Frequently Asked Questions About Will Vs Trust Pros And Cons

- What is the main difference between a will and a trust?

A will takes effect after death and requires probate; a trust can manage assets during life and avoid probate altogether. - Are trusts more expensive than wills?

Yes, establishing a trust typically involves higher initial costs due to its complexity compared to drafting a simple will. - Can I change my will easily?

Yes, wills are relatively easy to modify while you are alive; however, changes must comply with legal requirements. - Do trusts provide tax benefits?

Certain types of trusts can offer tax advantages that wills do not provide; this includes potential reductions in estate taxes. - Is privacy better with trusts or wills?

Trusts maintain privacy since they do not go through probate; wills become public records once probated. - Can I appoint guardians for my children in a trust?

No, guardianship designations must be made in a will; trusts focus on asset distribution rather than guardianship issues. - What happens if I die without either a will or a trust?

Your assets will be distributed according to state intestacy laws, which may not align with your wishes. - Can I have both a will and a trust?

Yes, many people use both tools together for comprehensive estate planning that addresses various needs.