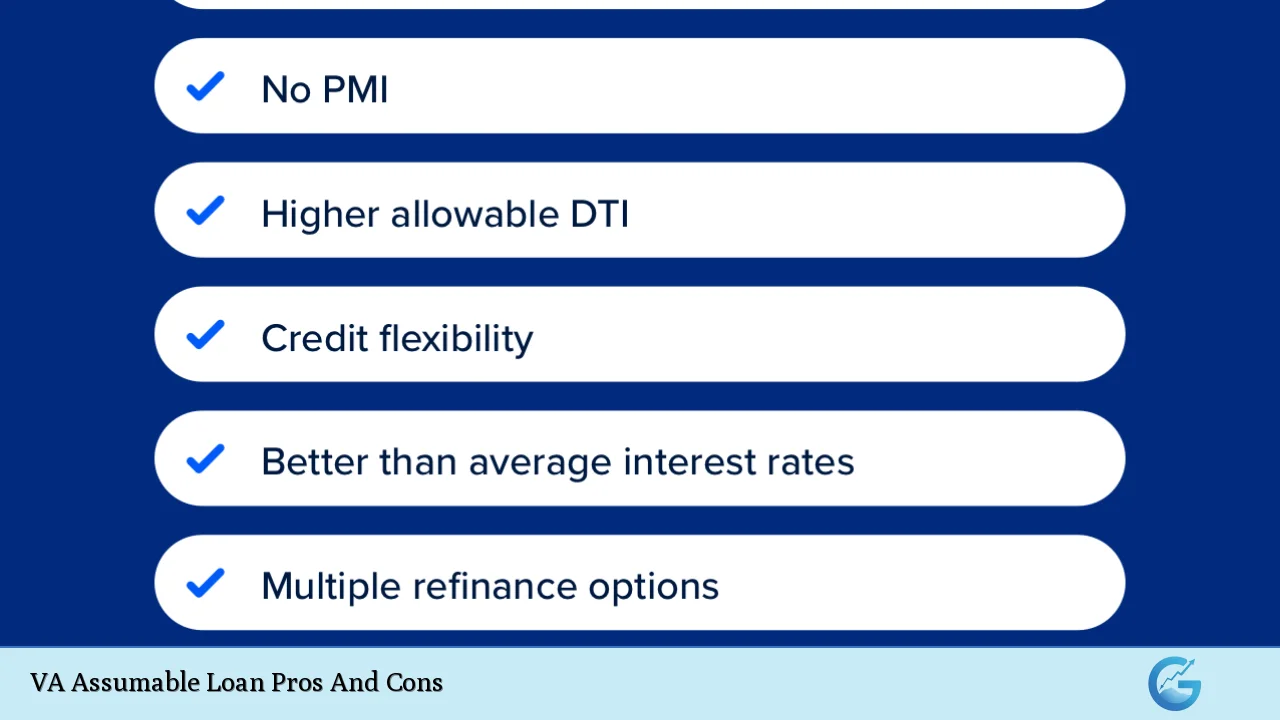

VA Assumable Loan Pros And Cons

The VA assumable loan is a unique financial instrument that allows a buyer to take over an existing VA loan from a seller, retaining the original terms of that loan. This process can be particularly beneficial in a fluctuating interest rate environment, as it enables buyers to inherit potentially lower interest rates. However, like any … Read more