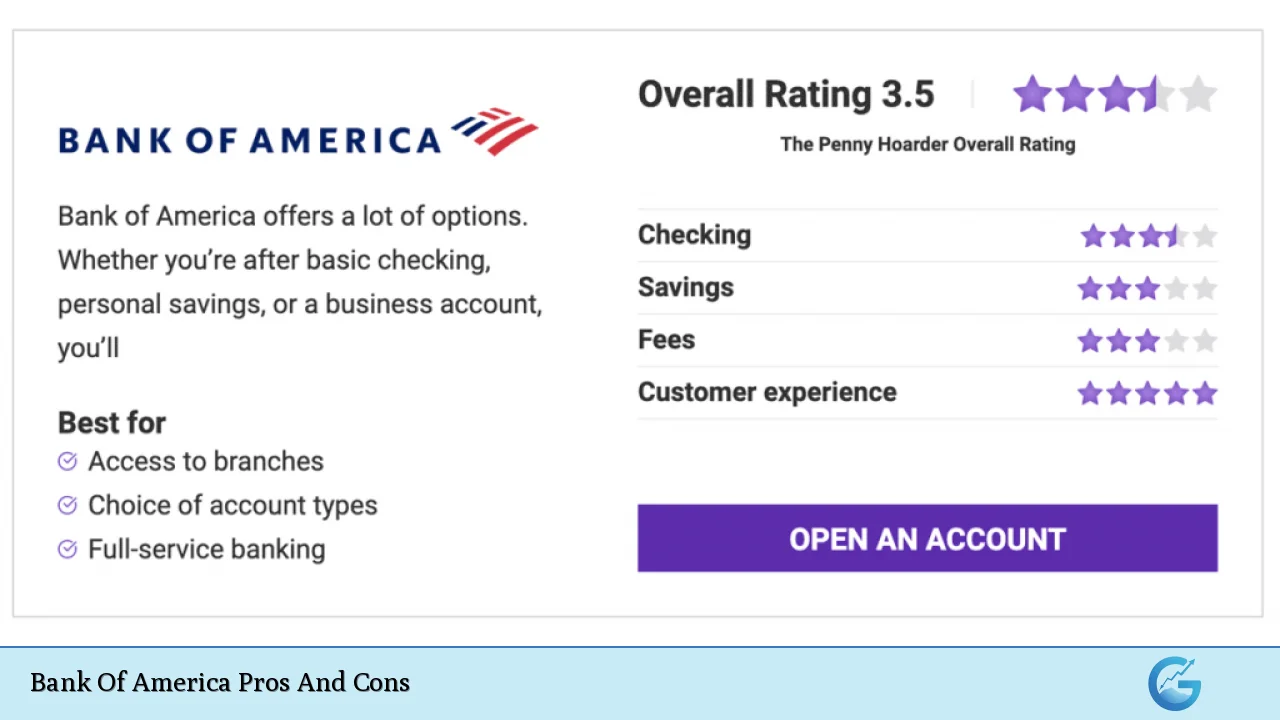

Bank Of America Pros And Cons

Bank of America (BofA) stands as one of the largest financial institutions in the United States, offering a wide array of banking services to millions of customers. With a significant presence across the country, BofA provides various products ranging from personal checking accounts to investment services. While it boasts numerous advantages, such as extensive branch … Read more