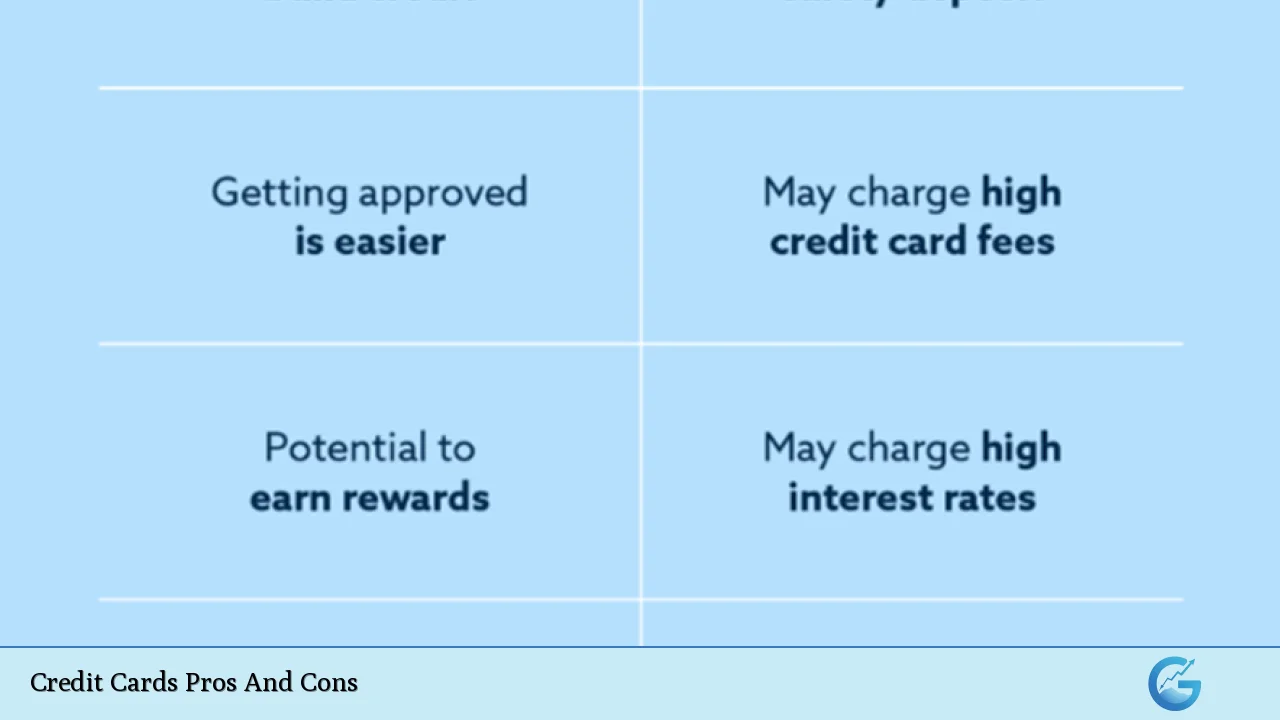

Credit Cards Pros And Cons

Credit cards have become an integral part of modern financial management, offering consumers a convenient way to make purchases without the immediate need for cash. They provide various benefits, including the ability to build credit, earn rewards, and enjoy consumer protections. However, they also come with significant risks, such as high-interest rates and the potential … Read more