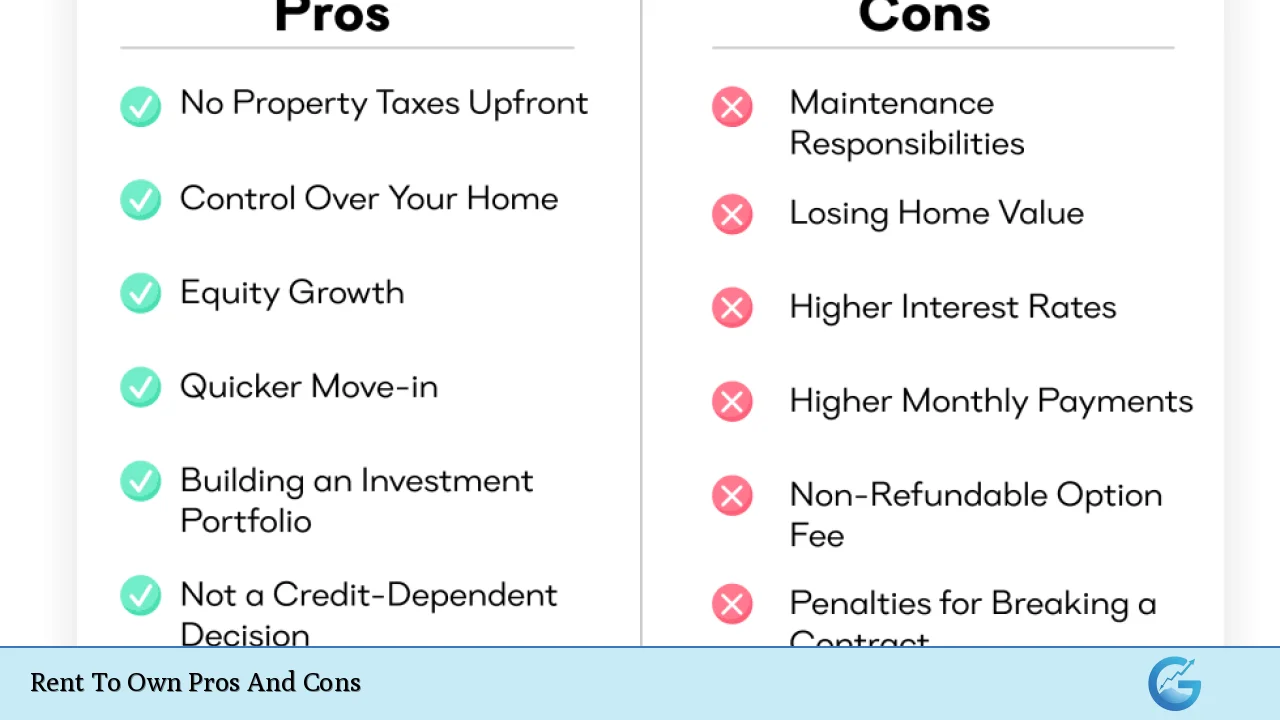

Rent To Own Pros And Cons

Rent-to-own agreements, also known as lease-option contracts, offer a unique pathway to homeownership for individuals who may not qualify for traditional mortgages. This arrangement allows potential buyers to rent a property for a specified period with the option to purchase it at the end of the lease term. While this approach can be appealing to … Read more