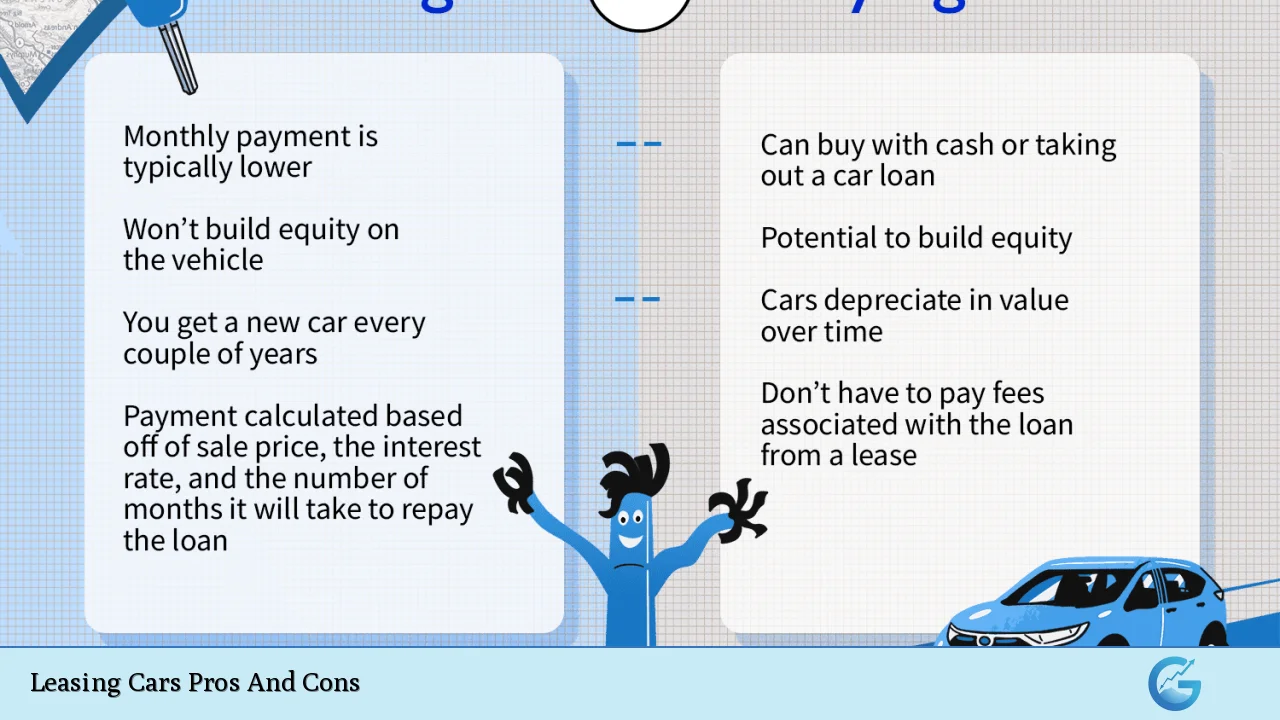

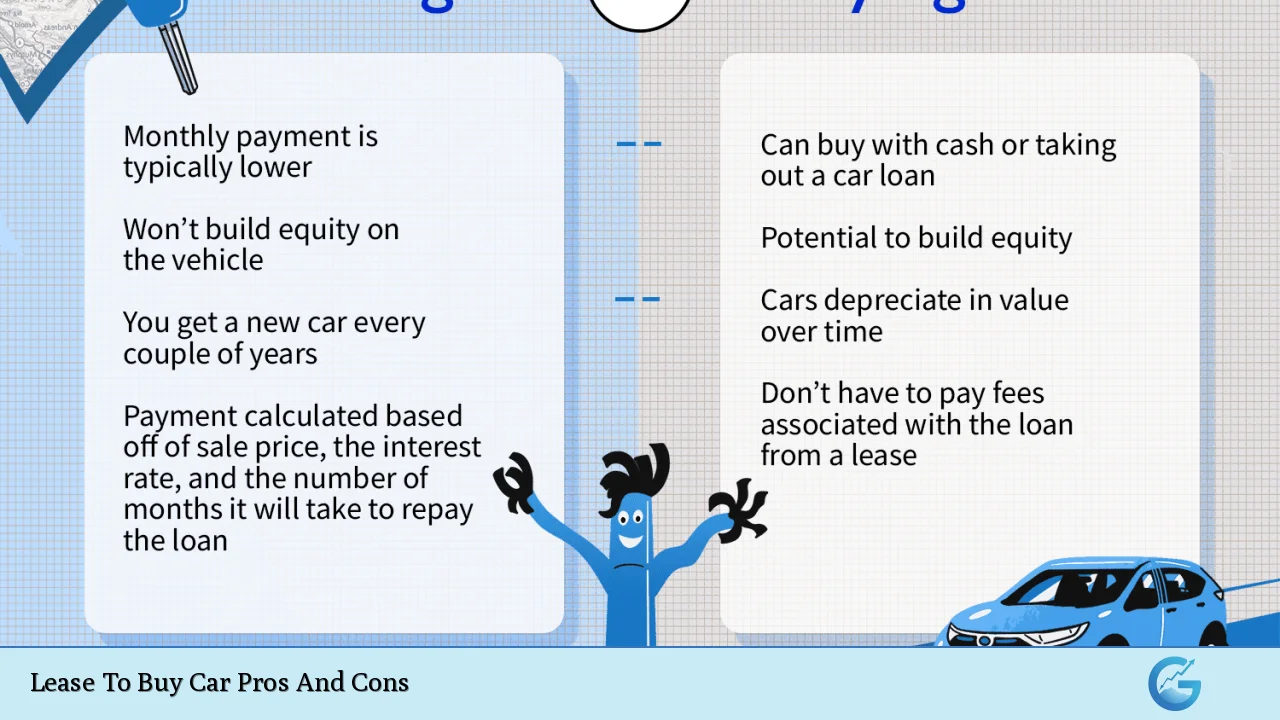

Leasing Cars Pros And Cons

Leasing a car has become a popular option for many consumers, particularly those who prefer driving new vehicles without the long-term commitment of ownership. This arrangement allows individuals to enjoy the benefits of a new car while avoiding some of the financial burdens associated with buying. However, leasing also comes with its own set of … Read more