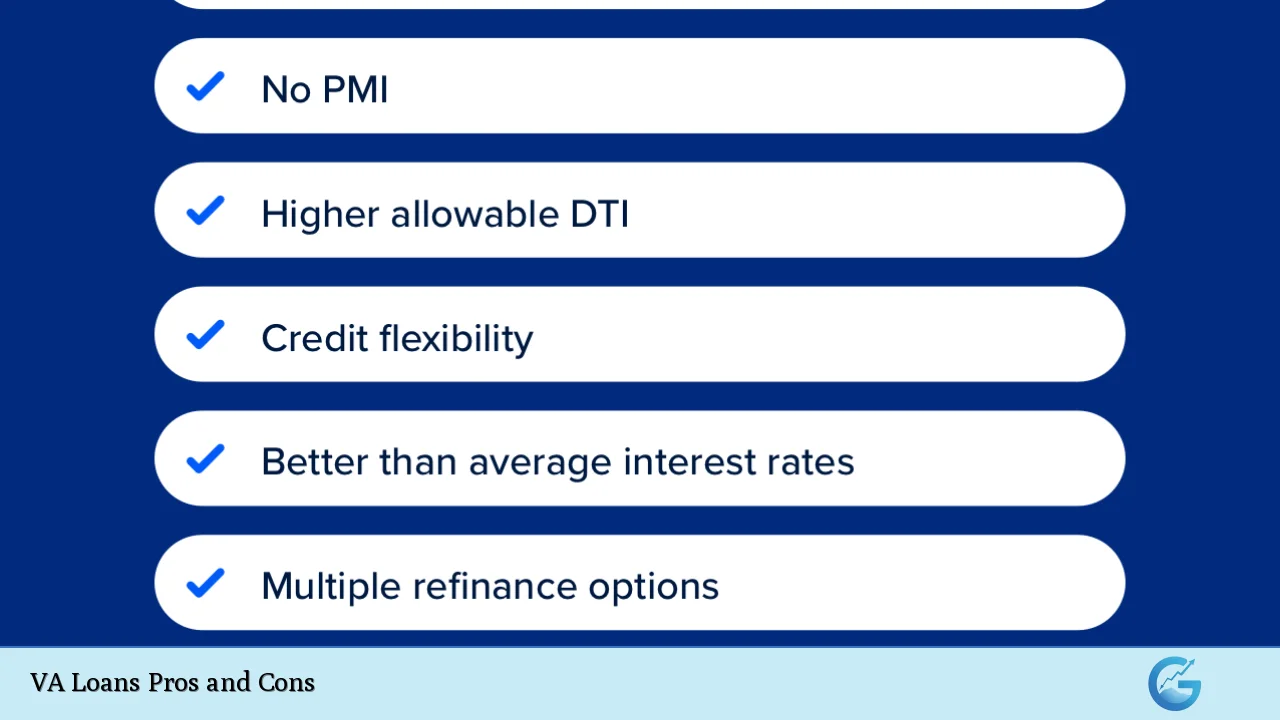

VA Loans Pros and Cons

VA loans are a unique financing option available to eligible veterans, active-duty service members, and certain surviving spouses. These loans, guaranteed by the U.S. Department of Veterans Affairs (VA), offer several advantages that can make homeownership more accessible. However, they also come with specific drawbacks that potential borrowers should consider. This article explores the pros … Read more