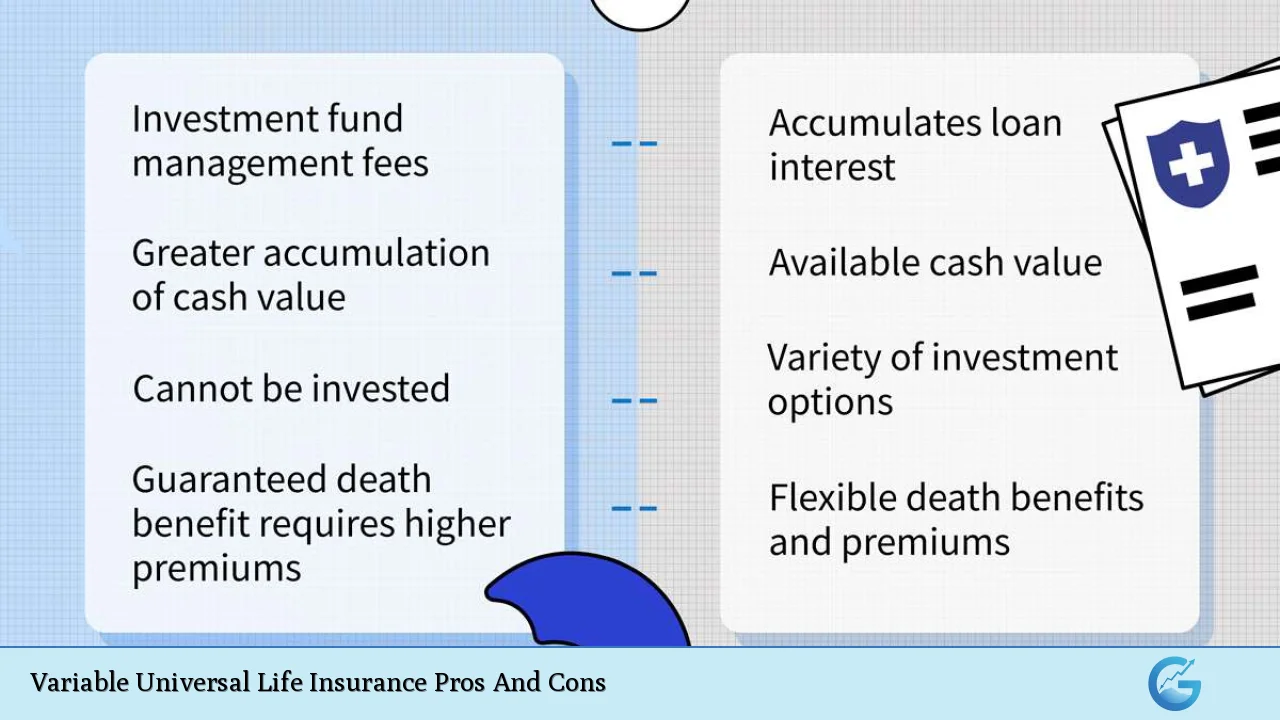

Variable Universal Life Insurance Pros And Cons

Variable Universal Life (VUL) insurance is a sophisticated financial product that combines the death benefit of traditional life insurance with the potential for investment growth. This type of policy offers policyholders the flexibility to adjust their premium payments and death benefits, while also providing an opportunity to invest in a variety of subaccounts, similar to … Read more